Are you planning your next home purchase? You might be excited, but most importantly, it’s going to be one of the most crucial financial decisions of your life. In India, property purchases can feel complicated with multiple documentation processes and fluctuating property prices. If you’re planning to fund your purchase through a home loan, the process of eligibility checks can be overwhelming.

To help you smoothly accomplish the process, this guide explains every step of buying a house in India, making it easy for first-time homebuyers to understand.

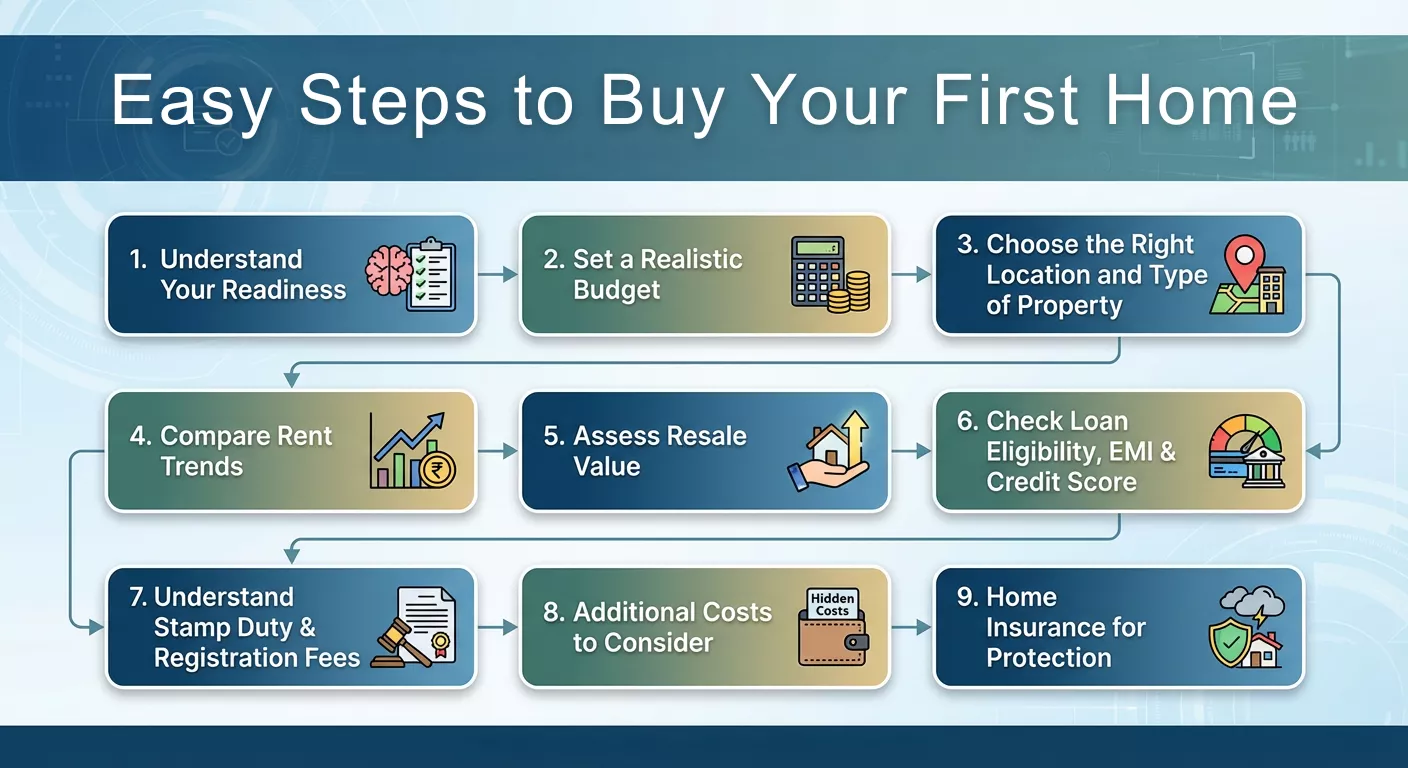

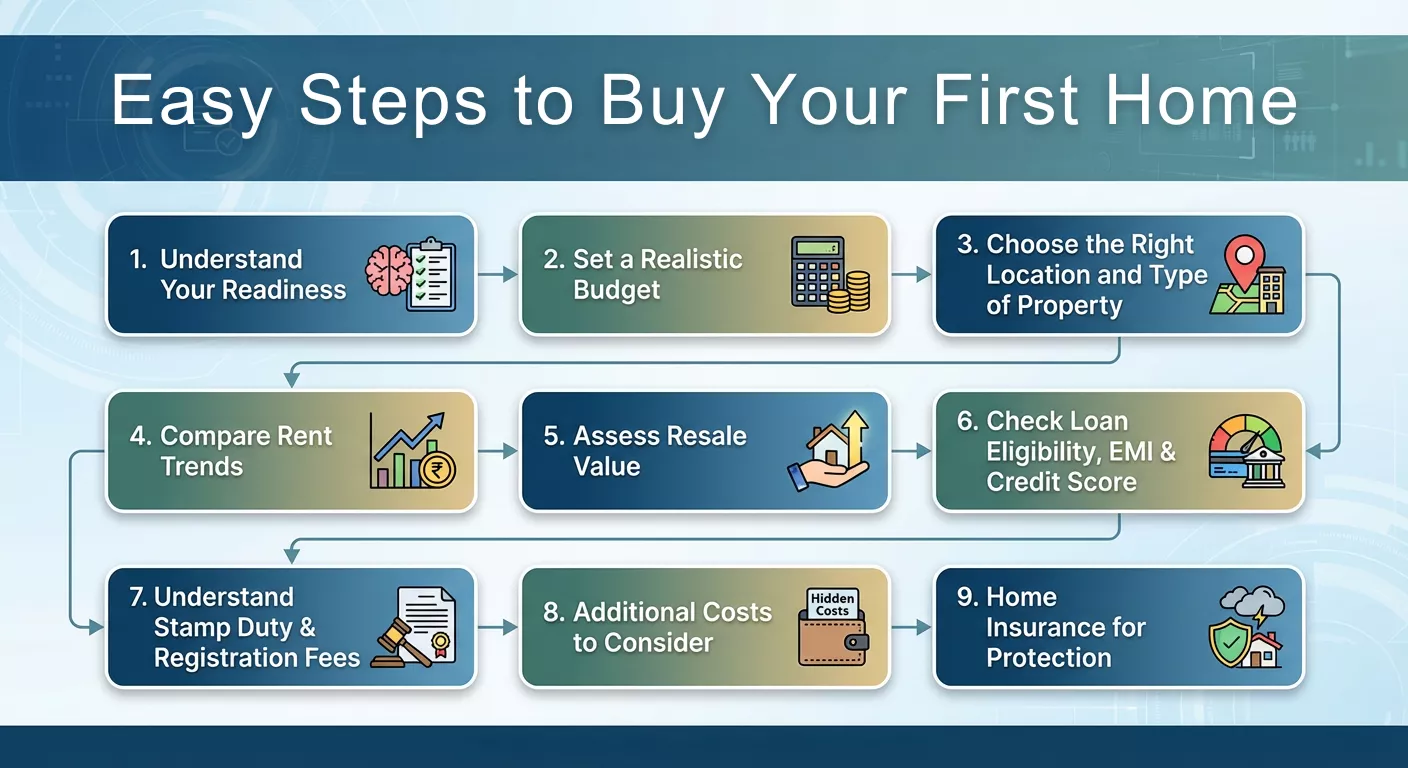

If you're buying a house for the first time, these steps will help you move through the process with confidence.

In the first place, evaluate whether you’re prepared to make the purchase. A house purchase requires both financial and emotional readiness. It is a long-term commitment. So, think about your financial stability, future plans, and where you will be standing in the next 10-20 years.

For a first-time home buyer, it’s crucial to understand this readiness and know the responsibilities that they would be shouldering. These include:

-

Maintenance

-

Repairs

-

Society charges

If you’ve been seeking clarity on buying a house for the first time, this primary step lays the foundation.

A number of factors depend on your budget. For instance, the location of the property, its size, and the loan amount that may be sanctioned depend on your budget.

Evaluate your income and savings per month. Next, calculate how much you can set aside for emergencies. Then, you need to allocate a budget for a down payment. Most banks require owners to shell out a down payment between 10% and 20% for the property.

It’s wise not to spend your entire savings on this down payment. The reason is, that you need to keep aside funds for expenses that may not be covered by your home loan. These include:

-

Interior designs

-

Moving expenses

-

Early maintenance

Once you have set a budget, calculate the ideal EMI. According to financial planners, borrowers must safely consider only 30% to 35% of their monthly income for the EMI. Use online EMI calculators to get a realistic overview of the amount you need to fork out each month while avoiding financial stress.

When you plan to buy a house, location is something you can’t possibly overlook. The right neighborhood can enhance your lifestyle. On the wrong one, a chaotic surrounding or lack of security can impact your daily routine.

As a first time home buyer, consider these factors while evaluating the location.

-

Distance from workplace.

-

Access to schools, hospitals, and public transport.

-

Safety and community culture.

-

Future infrastructure plans.

-

Green spaces and noise levels.

Once you finalize the location, choose the type of property you want to buy. Here are some of the common options for homeowners:

-

Ready-to-move flats

-

Under-Construction Apartments

-

Villas

-

Duplexes

-

Independent House

A first time property buyer should prioritizeprioritise essential amenities over luxuries. Also, check the reputation of the builder, project quality, and timelines for possession. All these decisions form part of the practical rules for buying a house. Accordingly, you can choose a home that matches your lifestyle and future needs.

Also Read: Commercial Vs Residential: Which is Better for Investment?

You may be planning to buy a home for living, and not as an investment. However, it is important to know the rent trends to gauge the long-term value of the property.

Evaluate the demand for rental homes in the area, current rental rates for similar homes, and vacancy levels.

If you want to rent out the home in the future, check the rental yield, which should be around 3-4% annually. It helps in recovering a part of your EMI.

A home is both an emotional and financial asset. Knowing the resale value helps you plan for the long term. Here are some factors that affect the property’s resale value.

-

Reputation of the builder.

-

Appreciation rates in the locality.

-

Upcoming infrastructure, like metro, highways, and tech parks.

-

Quality of construction.

-

Floor preference and layout.

While understanding how buying a house for the first-time, it’s important to understand that you shouldn’t get carried away by trends. Take time to know the long-term prospects of the project. A property with strong resale potential gives you flexibility in case your life plans change later.

If you are planning to purchase your property through a home loan, try to understand how the process works.

Banks will check:

-

Your age

-

Stability of income

-

Type of employment

-

Existing loans

-

Credit score

If you have a CIBIL score of 750 or higher, it significantly improves the chances of approval. Also, maintain a healthy Debt-to-Income (DTI), which should ideally be below 40%.

Next, you need to compare loan options across reputed banks and NBFCs. The one with the lowest interest rate is preferable, but make sure to look into other aspects, too. These include:

-

Processing Fees

-

Prepayment Charges

-

Maximum Loan Tenure

A pre-approved home loan can speed up the process.

The amount you need to fork out as stamp duty and registration charges varies significantly from state to state. These charges amount to 5-7% of the property value in some regions. Stamp duties and registration charges are the fees charged by the government, as the property ownership legally gets transferred to you.

One of the common mistakes buyers often make is ignoring these additional charges. Home loans do not typically cover stamp duty and registration charges. So, you need to plan separately for them to avoid financial strain at the last minute.

A number of smaller expenses add up beyond the purchase price. These include:

-

Maintenance deposits

-

Society formation charges

-

Property insurance cost

-

Parking fees

-

Legal verification charges

-

Interior and furnishing costs

-

Brokerage fees

-

Property tax for the first year

Make sure to budget for these expenses, so that you don’t face unpleasant surprises down the line. Work closely with a property lawyer, particularly for title checks, deed review, and verification of approvals. A small investment in due diligence protects you from major future risks.

One of the most overlooked costs associated with buying a home is its insurance. It protects your property from risks like:

-

Fire

-

Theft

-

Natural disasters

-

Damage to structure or contents

Premiums are affordable, and the security you get is invaluable. Particularly, if you’re taking a large loan to fund the purchase, getting the property insured is highly recommended. Investing in property insurance is one of the essential yet neglected aspects when owners buy a home in India.

While buying a home, it’s imperative to factor in several aspects to decide the right time to make the investment. Have a look at the common conditions that point towards a favourable period for purchasing a property.

Lower rates of interest

Considering the massive home loan you need to purchase a property, it’s wise to apply for financing when interest rates remain low in the market. This makes the ownership process of your property more affordable as favourable interest rates translate to lower EMIs.

Stability in the Property Market

Now that you are eyeing better returns on your property investment, purchase your new house when the market remains stable. This ensures that property prices will keep escalating in the coming years, and you can expect better rental returns from the home. It’s wise to invest in a property market when the price trend goes upwards.

Favourable Economic Conditions

It’s wise to factor in other economic conditions in the country while investing in the property market. Consider employment rates, job growth, and lower poverty levels while making the financial decision. Often, robust confidences in other sectors translate to a stable property market.

Incentives from the Government

In recent years, the Government of India has rolled out several incentives for property buyers. Before buying a house, check out tax reliefs, incentives on home loan interests, and other benefits available from the government in your region.

Family Planning

Are you planning to start a family soon? Consider your life goals before you purchase a property. Make sure to gain stability in your career before you plan to buy a home.

Long-Term Stay

In case you are buying a home to stay in the locality for a long time, you can benefit in terms of capital value appreciation of the property. Accordingly, you can carry out realistic financial planning for the long term.

Better Negotiation Power

When you purchase a property in a buyer’s market, you can benefit from better negotiation power. Investing at a time when the available inventory exceeds demand, you can settle for a better price and take advantage of more favourable terms. Sellers often offer additional concessions during such periods.

Considering these aspects, it would be a wise decision to purchase your property in India now.

Young buyers often balance EMIs with career growth and lifestyle goals. Here are a few practical tips that can make their property purchase hassle-free.

-

Don’t stretch your budget to get the maximum loan amount.

-

Consider short-term stability while planning your EMI.

-

Choose projects with good connectivity instead of simply focusing on luxury features.

-

Check the RERA history of the builder before you commit

Are you planning to buy a house? With the demand for housing steadily increasing in Indian cities, investing in a new property brings you valuable prospects. With new SEZs and upgrades in infrastructure, real estate prices are likely to rise.

Interest rates on home loans have stabilized, and many developers are offering flexible payment options. That’s the reason many potential owners are planning to buy a home. Potential growth opportunities of the real estate market, and stable interest rates make it a favourable choice.

Buying a home might be a long-term goal for you. With the right preparation and insights, the process becomes smoother and more enjoyable. So, if you had been wondering how can I buy house in India, we have comprehensively discussed the process in this guide. Follow these steps as you buy a new home and embrace the dream lifestyle you had always thought of.

If you are buying a home for the first time, focus on your long-term needs, financial ease, and personalization. With the right mix of planning and careful evaluation, purchasing your home in India becomes an achievable and fulfilling journey.

FAQs

Yes, buying a property in India will be a great decision from an investment perspective. By 2025, the real estate industry in India is likely to account for as much as 13% of the country’s GDP. In major cities, prices of houses are likely to increase in the short run.

In India, buyers can look out for homes across various price ranges. Based on your budget, save at least 20% of the property cost for down payment and another 6% as registration cost. Additionally, save enough to purchase new furniture or decorate your new home.

Yes, foreigners and NRIs can buy properties in India. In fact, the Indian government provides several perks to foreigners purchasing houses in this country.Â

While buying a house, it’s crucial to look out for the right location. Go for an area with a strong potential for development in the future. Also, make sure that your workplace and key commercial areas around the city are easily reachable. It’s wise to acquire a home close to the reputed schools and hospitals in your city. Moreover, consider the transit system and accessibility to shopping malls, markets, and places of recreation. If you are planning to settle in the area for long, it’s wise to check out the social infrastructure and choose the location tactically.