The new RBI Governor Mr. Urjit Patel announces Diwali gift for all the existing borrowers and for anyone and everyone who is planning to take a loan. The Reserve Bank of India has recently announced a cut of 0.25% in the repo rate, pushing it down to 6.25% from the existing 6.5%, while keeping the Cash Reserve Ratio the same. This landmark cut is the result of a unanimous decision taken by a six-member Monetary Policy Committee. A deduction in the repo rate would mean lowering of loan interest rates, smaller EMI’s, more long-term savings and hence, more disposable money in the pockets.

What is Repo Rate?

The Reserve Bank of India, in order to manage or control the inflation and economic growth, uses some tools like Repo Rate, Reserve Repo Rate, Cash Reserve Ratio (CRR) and Statuary Liquidity Ratio (SLR). Repo Rate refers to the rate at which the banks borrow money from the RBI by selling off their surplus government securities to RBI. It is the short form of Repurchase Rate. For example, if the repo rate is 6.5% and the banks borrow Rs 1000 from RBI, they will pay an interest of Rs 65 to the RBI. Higher the repo rate, higher the cost of short term money. Lower repo rates will allow banks to charge lower interest rates on the loans taken by us, which will lead to a positive momentum in the economy.

Cash Reserve Ratio refers to the amount of funds that need to be deposited compulsorily with the RBI.

Impact of cut in the repo rate on home loan borrowers

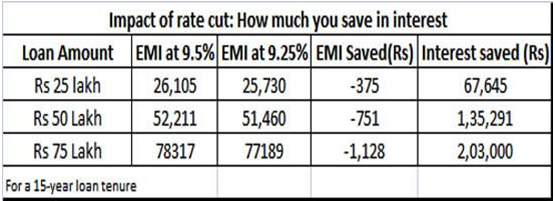

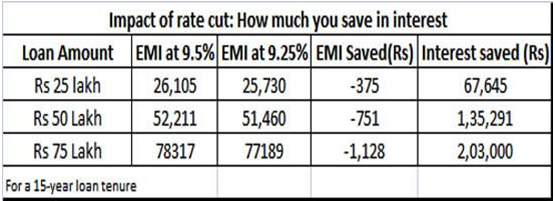

Though a 0.25% cut might not seem to be attractive enough at the moment but if the rate keeps on dipping low the same way and the banks pass on this profit to the lenders, the cumulative impact could be huge resulting in excellent savings in interest over a long time period. For Example for a home loan of Rs 40 lakhs for tenure of 15 years, a 0.25 percent cut from 9.5% to 9.25% would mean a saving of Rs 1 lakh in the total interest burden.

The difference in the savings for different loans amounts is as calculated below:

How is bank’s MCLR affected?

This rate cut would also lead to a lower MCLR (bank’s Marginal Cost of Funds based Lending Rate) which they announce every month. Home loans linked to MCLR are set either annually or after 6 months, hence, the actual impact on the new borrowers might be a few months away.

Existing home loan borrowers

For those who are already running home loans at a flexible interest rate, there are two ways to avail this benefit – either get the tenure reduced or ask for a reduction in the monthly EMI. Normally, the banks automatically reduce the tenure of your loans in order to provide you with the benefit of lower interest rate but in case you want the monthly installment to be reduced, check with your loan account first and then contact the bank for the same for which you will have to sign a revised ECS (Electronic Clearing Service) mandate

Switch over

An existing borrower can also opt for a loan switch over at current Rate of Interest but in this case, one might have to shell out 0.5% plus taxes. For example, if the ROI for new borrowers is 9% and you are paying 10.5%, you can request for a loan switch over.

Foreclosure

In case the Rate of interest of your lending institution is higher than the competitors you can get your loan foreclosed and transfer it to a new lender. There won’t be any foreclosure charges if the housing loan is running on fixed interest basis. .

Hence, whether you reduce the tenure or EMI or transfer your loan to another lender, calculate your interest saved in doing so. The impact of rate change will not be much in case of an old loan nearing completion. And, in case the existing loan is 3 years old and rate difference is considerable, it is advisable to get it refinanced or go for a switch over.